- تحليلات

- التحليل الفني للسوق

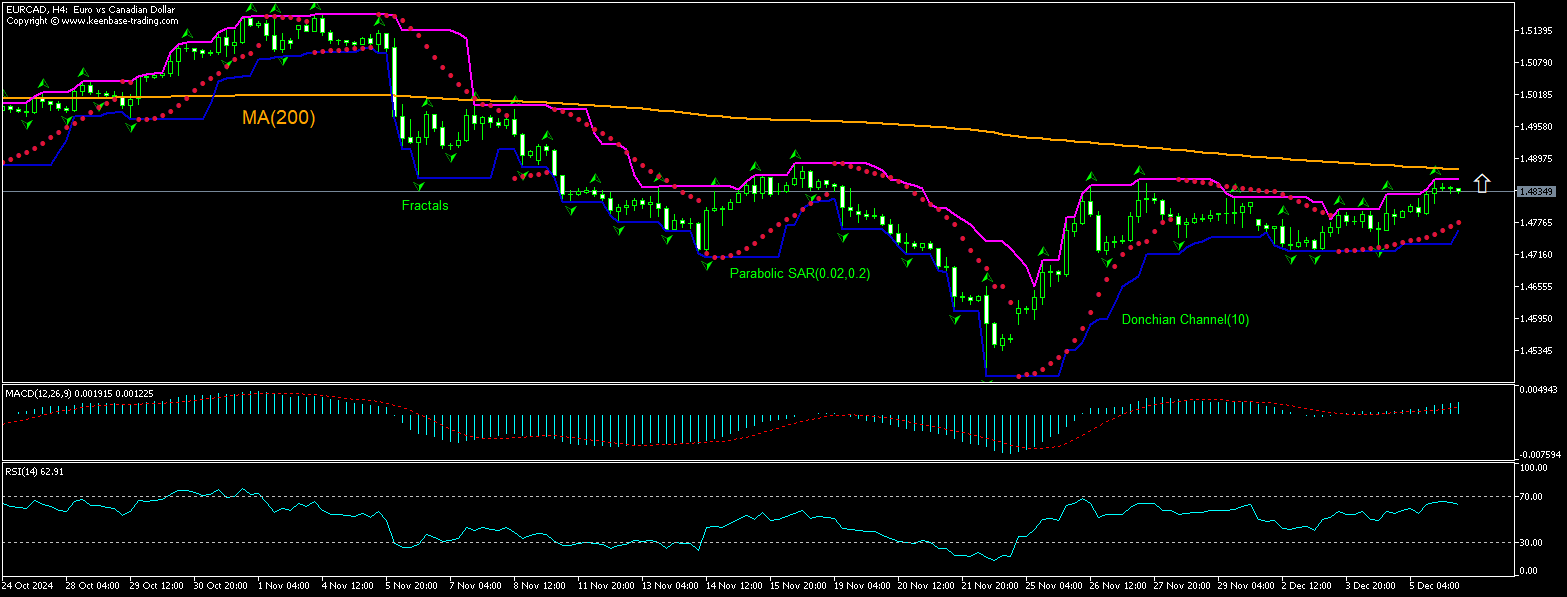

EUR/CAD التحليل الفني - EUR/CAD التداول: 2024-12-06

EUR/CAD ملخص التحليل الفني

أعلى من 1.4857

Buy Stop

أقل من 1.4776

Stop Loss

| مؤشر | الإشارة |

| RSI | محايد |

| MACD | شراء |

| Donchian Channel | شراء |

| MA(200) | بيع |

| Fractals | شراء |

| Parabolic SAR | شراء |

EUR/CAD تحليل الرسم البياني

EUR/CAD التحليل الفني

The technical analysis of the EURCAD price chart on 4-hour timeframe shows EURCAD,H4 is testing the 200-period moving average MA(200) which is declining itself. We believe the bullish momentum will resume after the price breaches above the upper bound of the Donchian channel at 1.4857. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.4776. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

التحليل الأساسي لـ الفوركس - EUR/CAD

Canada’s trade deficit narrowed in October. Will the EURCAD price decline?

Canada’s trade surplus with the US helped the country narrow its overall trade deficit: the Statistics Canada reported Thursday country’s trade deficit declined to C$924 million ($658 million) from C$1.3 billion in September as total imports exceeded exports for the eighth straight month in October. Total exports grew 1.1% in October, led by gold, while imports rose 0.5% on higher metal ore purchases. A Canada trade deficit narrowing is bullish for EURCAD. However the same day Destatis data showed real (price adjusted) new orders in German manufacturing declined in October less than expected. A smaller than the expected decline in new orders in German manufacturing is bullish for EURCAD. The current setup is bullish for the currency pair. Destatis is due to report October German Industrial Production data at 11:00 CET today. German industrial production is expected to have reversed its decline. There is a likelihood the improvement in German industrial production is less than the forecast of 1%. A smaller than expected improvement in German industrial production is a bearish risk for EURCAD.

:تنبيه

يحمل هذا الموجز طابعاً إعلامياً و تعليمياً و تنشر بالمجان . تأتي معظم البيانات المدرجة في الموجز من المصادر العامة معترفة أكثر و أقل موثوقية . مع ذلك ، لا يوجد تأكيد على أن المعلومات المشارة إليها كاملة و دقيقة . لا يتم تحديث الموجز . معظم المعلومات في كل موجز ، تتضمن الرأي و المؤشرات و الرسوم البيانية و أي شيئ اخر وتقدم فقط لأغراض التعريف وليس المشورة المالية أو توصية . لا يمكن اعتبار النص باكماله أو أي جزء منه و أيضاً الرسوم البيانية كعرض لقيام بصفقة بأي اداة . آي إف سي ماركيتس وموظفيها ليست مسؤولة تحت أي ظرف من الظروف عن أي إجراء يتم اتخاذه من قبل شخص آخر أثناء أو بعد قراءة نظرة عامة .